FL Mileage Reimbursement Form free printable template

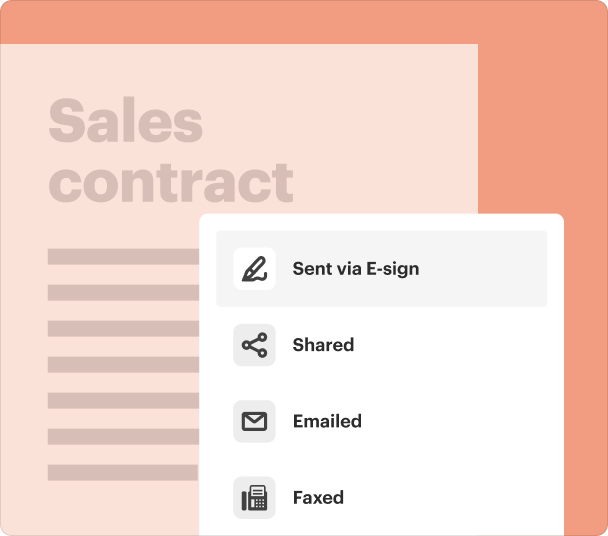

Fill out, sign, and share forms from a single PDF platform

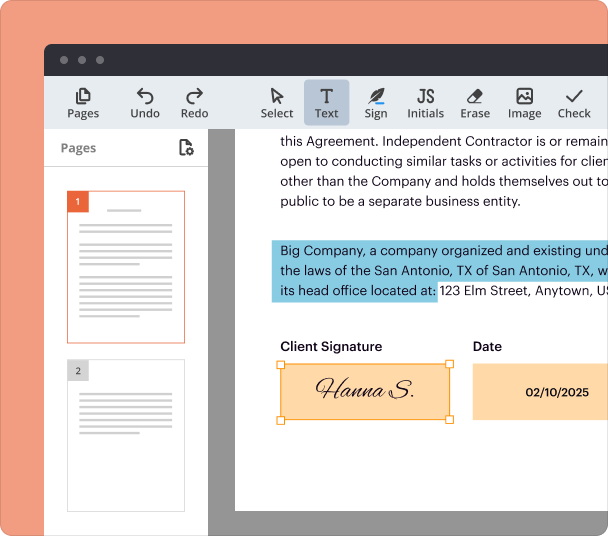

Edit and sign in one place

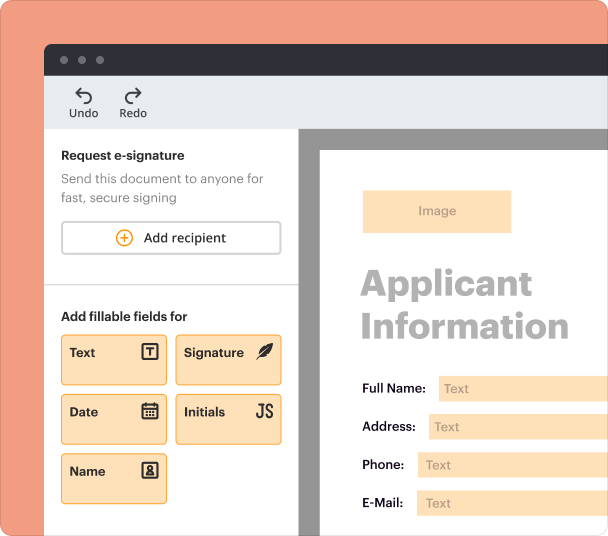

Create professional forms

Simplify data collection

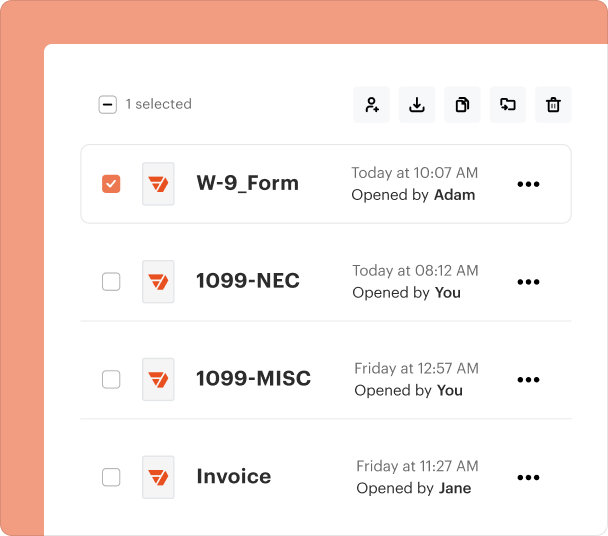

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

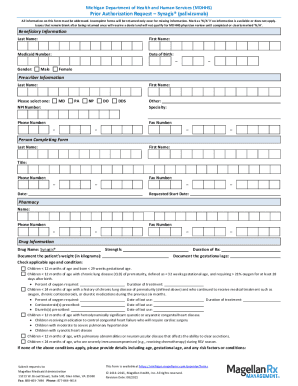

Understanding the Florida Mileage Reimbursement Form

What is the Florida Mileage Reimbursement Form?

The Florida Mileage Reimbursement Form is a document that allows individuals to claim reimbursement for travel expenses incurred while traveling for work-related purposes or medical appointments. It is typically used by employees who need to submit their mileage claims to employers or insurance companies to receive compensation. This form ensures that all necessary details related to the travel are documented, facilitating a smooth reimbursement process.

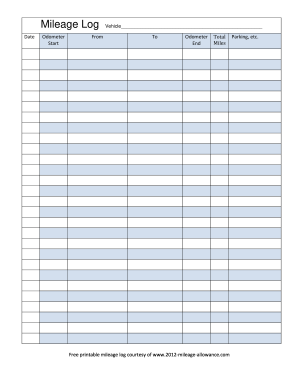

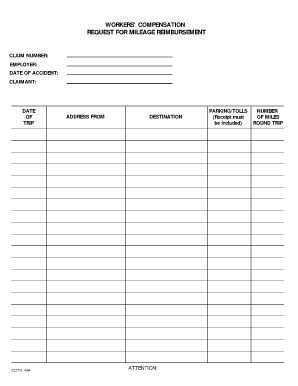

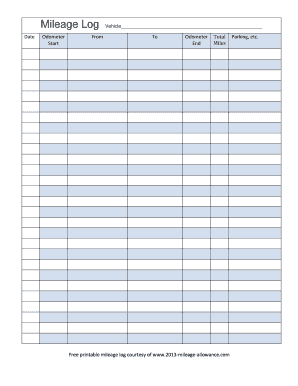

Key Features of the Mileage Reimbursement Form

The Florida Mileage Reimbursement Form includes several important features designed to streamline the claim process. Key components of the form typically include the claimant's name, social security number, address, dates of travel, and specific details about the trips taken, including round-trip mileage calculations. Additionally, the form often requires a signed certification statement where the claimant affirms the accuracy of the information provided.

Eligibility Criteria for Using the Form

To be eligible to use the Florida Mileage Reimbursement Form, individuals must be engaged in travel for valid work-related reasons or for visits to medical facilities. Generally, employees, contractors, or other parties making claims under relevant Florida statutes are eligible. It is important to understand the specific guidelines that apply to your situation, as different employers or insurance companies may have varying criteria.

How to Complete the Mileage Reimbursement Form

Completing the Florida Mileage Reimbursement Form involves several key steps. First, gather all necessary information, including your travel dates, destinations, and total mileage. Fill out the form accurately, ensuring that all fields are completed. Pay particular attention to the certification statement, as it requires your signature, affirming the accuracy of your claim. Double-check the form for any errors or omissions before submission to avoid delays in processing your request.

Common Errors and Troubleshooting

When completing the Florida Mileage Reimbursement Form, individuals may encounter common errors such as incorrect mileage calculations or missing signatures. A frequent issue is failing to provide sufficient documentation of the trips taken. To avoid these pitfalls, it is advisable to keep a log of your travels and to review the completed form thoroughly. Consider reaching out to your employer or the relevant insurance provider for clarification if there are uncertainties about the required information.

Benefits of Using the Florida Mileage Reimbursement Form

Utilizing the Florida Mileage Reimbursement Form presents various benefits for individuals seeking compensation for travel-related expenses. The structured format ensures that all necessary information is captured, aiding in expedient processing of claims. Additionally, having a formalized document safeguards both the claimant and the employer, providing a clear record of expenses incurred during official duties. This can enhance transparency and promote trust in the reimbursement process.

Frequently Asked Questions about mileage reimbursement form

Who can submit the Florida Mileage Reimbursement Form?

Any employee or individual traveling for work-related reasons, including visits to medical facilities, can submit the Florida Mileage Reimbursement Form.

What should I do if I make a mistake on the form?

If you make a mistake on the Florida Mileage Reimbursement Form, it's advisable to correct the error before submission. If submitted already, contact the relevant office for guidance on how to amend your claim.

pdfFiller scores top ratings on review platforms